Sold Goods on Credit Journal Entry

A sales journal entry is the same as a revenue journal entry. Terms Similar to Sales Journal Entry.

Question No 10 Chapter No 5 Usha Publication 11 Class Tutor S Tips

In this journal entry there is no freight-in account as the freight-in cost is included in the cost of the inventory.

. It made sales for 50000000 in Aug 2019 and it sold 60 on a cash basis and the rest was sold on a credit basis. To record sale of goods to your customers Sales. The job cost accounting journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting of job costing.

Sold goods on credit is nothing but the sale of goods on a credit basis ie. She buys machines A and B for 10 each and later buys machines C and D for 12 each. Providing goods to the customer with an expectation of receiving the payment in the future.

Once you prepare your information generate your COGS journal entry. Essential Points about Sales Return Journal Entry. Buy Goods on Credit Bookkeeping Entries Explained.

This is because they are items of monetary value for the business - the business will sell them to. The goods were sold on credit for 1000 in the previous week and the customer had not made the payment yet. The sales journal entry is.

Jane sells machines A and C for 20 each. It may be useful to note that most companies consider the allocation of the freight-in cost to the merchandise inventory to be wasteful of time and effort and they usually record the freight-in cost into the cost of goods sold directly when this cost is considered to be. The goods sold have a cost of 650.

Journal Entry for Cost of Goods Sold COGS The following Cost of Goods Sold journal entries outline the most common COGS COGS The Cost of Goods Sold COGS is the cumulative total of direct costs incurred for the goods or services sold including direct expenses like raw material direct labour cost and other direct costs. The above helps you. The company had 31000000 in outstanding receivables and 2500000 in cash at the end of Aug 2019 balance sheet.

Expenses are recorded in a journal entry as a debit to the expense account and a credit to either an asset or liability account. Under specific identification the cost of goods sold is 10 12 the particular costs of machines A and C. When adding a COGS journal entry debit your COGS Expense account and credit your Purchases and.

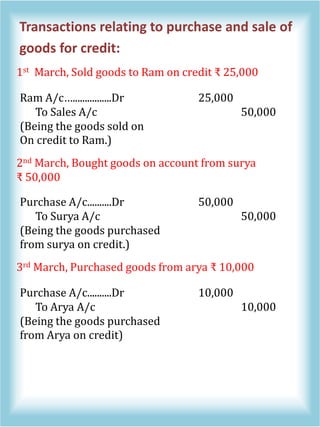

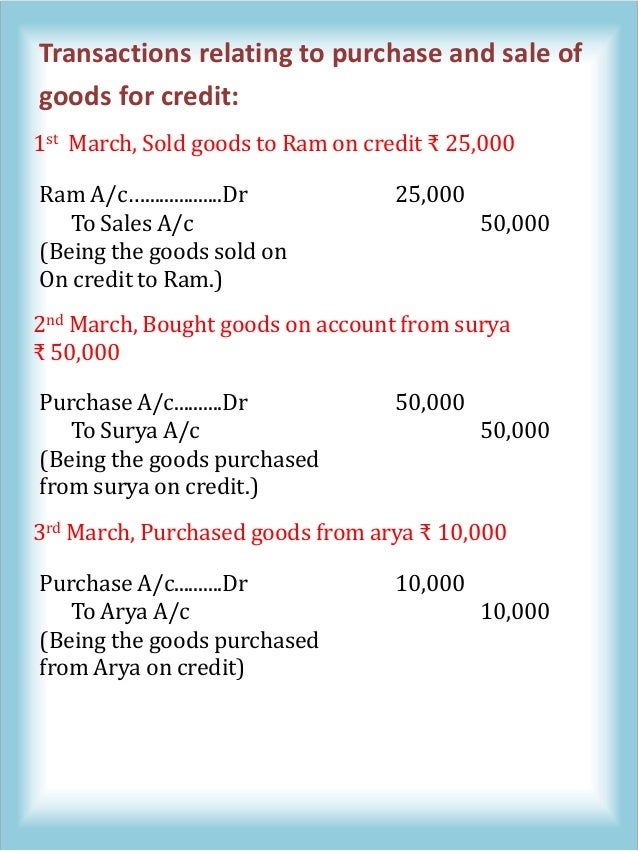

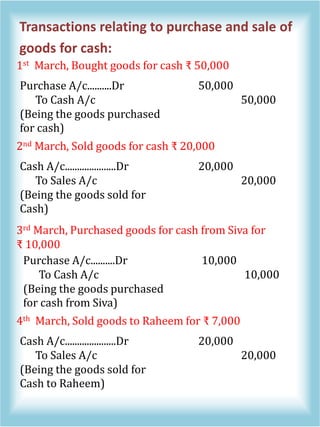

The journal entries follow the job costing process from purchase of raw materials allocation of direct materials direct labor and manufacturing overhead to work in process. What is the journal entry for the following. Purchased goods from KJ Mehta for cash.

If using the accrual method a business needs to simultaneously record the cost of goods and the sale of said goods. Additionally if we use the perpetual inventory system it will also result in the increase of the cost of goods sold on the income statement as well as the decrease of the asset which is the merchandise inventory on the balance sheet on. Rupees Indian currency A.

Journal Entry for Purchasing Goods. Example Journal Entry for Credit Sales. Many companies sell goods on either a cash basis or credit.

In this journal entry the cost of goods sold increases by 1000 while the inventory balance is reduced by 1000. In this case the company ABC can make the journal entry for credit memo by debiting the 1000 in sales returns and allowances account and crediting the 1000 in accounts receivable to reduce the amount that the customer owes. Likewise the company can view the updated outstanding balance of inventory on the balance sheet as well as the updated figures of the cost of goods sold in the income statement after this journal entry without needing to make physical inventory count and.

According to the golden rules of accounting. Create a journal entry. Post a journal entry for Goods sold for 5000 on credit to Mr Unreal.

Cash sales on the other hand are simple and easy to account for. You may be wondering Is cost of goods sold a debit or credit. The sold merchandise on account will result in the increase of both total revenues and total assets on the day of selling the merchandise.

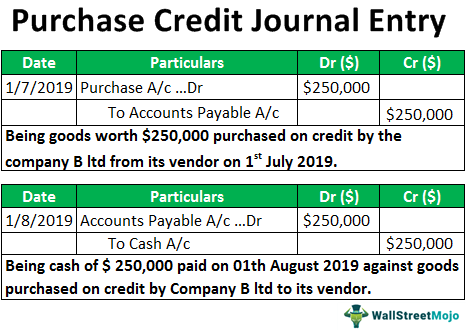

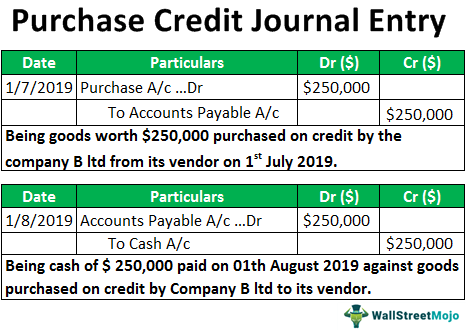

Buy Goods on Credit Journal Entry. Her cost of goods sold depends on her inventory method. The respective debtor account is debited while the sales account is credited.

Journal entry for sold goods on credit. Debit What came into the business The goods came into the business and will be held as part of inventory until sold. Being 25 Washing Machines 75000- sold to Mehta Traders on credit Note.

A Journal Entry records the business transaction on a day-to-day basis. Related Topic Journal Entry for Credit Purchase and Cash Purchase Accounting and Journal Entry for Cash Sales. Debit Accounts receivable for 1050 debit Cost of goods sold for 650 credit Revenue for 1000 credit Inventory for 650 credit Sales tax liability for 50.

Lets understand the details of the journal entry how TallyPrime helps you to record the journal voucher quickly. Be sure to adjust the inventory account balance to match the ending inventory total. Credit What went out of the business.

Goods or stock or inventory all these words mean the same thing are classified as assets in accounting. However it excludes all the indirect expenses. All the machines are the same but they have serial numbers.

A Journal Entry In Accounting Is The Learn Accounting Facebook

Purchase Credit Journal Entry Definition Step By Step Examples

Buy Goods On Credit From A Supplier Double Entry Bookkeeping

Comments

Post a Comment